Euronext Annual Conference 2020 Review

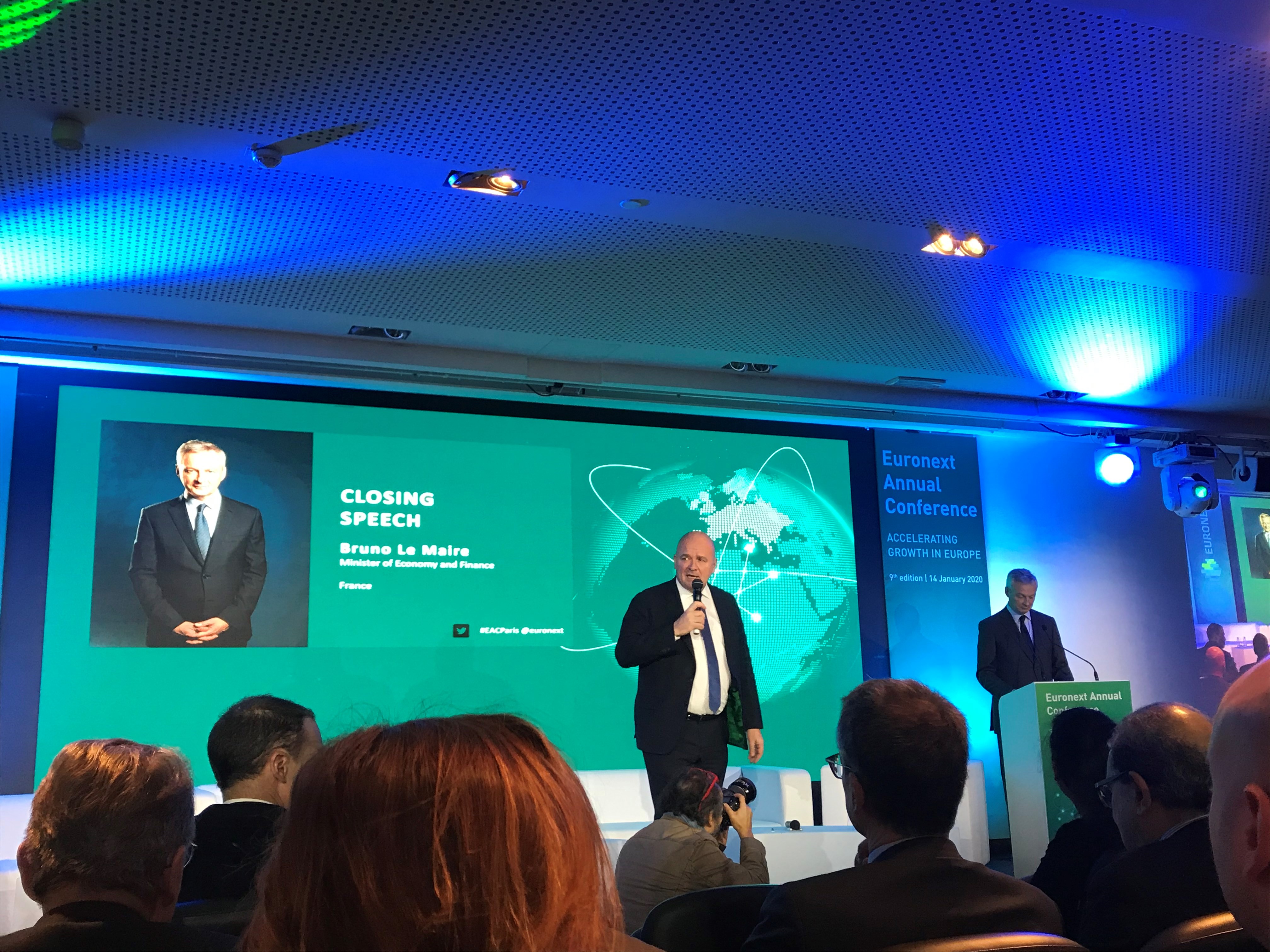

On 14th January at the 9th edition of the Euronext annual conference #EACParis @euronext French Minister of Economy and Finance Bruno Le Maire shared his ambition for France’s drive to achieve a European development model—one that promotes sustainable capitalism, concerned with fairness and reducing inequalities, and standing tall in the world across from the Chinese or the American models. This can be got through solidarity, better financing tools, economic integration and in making collective investments. A successful Capital Markets Union goes a long way in providing the financing platform to achieve that.

Kicked off by Euronext CEO Stéphane Boujnah with tempo and a vision for developing a strong European Bourse,expanding into a “Nordic alliance” with latest addition of the Oslo Bors, and later in the day a fantastic keynote from Norway’s Minister of Finance, Siv Jensen, the day was dedicated to examining all the angles of what is current in today’s European capital markets—how to look at public vs private markets, how to allocate capital in low interest-rate environments, how passive investors can play a role in shaping the governance companies so badly need, how Europe can deliver the Capital Markets Union it has been so badly wanting. Remarks from panels and keynotes alike were insightful and abuzz with energy about the opportunity.

Having let this event sink in for 24 hours, here are some of the key take-aways that resonated for us. Patrick Pouyanné, CEO TOTAL was robust about “the Greta effect” and the pressure on TOTAL to move to clean energy: still 90% of the world’s energy is fossil fuel—this is a massive and profound transformation of the sector and it will take time. Investors have multiple agendas, and dividends are part of it, so the company has competing agendas. His secret? Keep the conversation factual on what is actually possible to counter the emotion it triggers.

A panel on private vs public markets extolled the importance of share ownership—long term the returns really pay off and Sophie Javary (BNP Paribas) advocates for share-based savings instruments. Stephane Pallez shared her recent experience in listing FDJ as CEO and reiterated the importance of finding long term shareholders that can help a company grow—and the responsibility to success the company has to them. For Apollo’s Jean-Luc Allavena, the private and public phases are complementary—and there are simply times when a private equity fund can stop a centenary-old business from collapsing by taking it on. Staying in liquidity is not an option especially in low rate environment. In a panel on capital allocation BlackRock’s Isabelle Mateos y Lago identified the ‘fast flowing rivers’: – disruptors (clean tech, fintech, med tech…) – China (growth is still high despite economic slowdown) and -companies that are in the throes of energetic transitions

Blanqué (Amundi) expects lower returns in the future and Alain Papiasse (BNP Paribas) reminds us of the pressure to keep yields at 2.5-3% in order for the large pension funds to be able to afford the pension payout.

When examining how passive funds can be active, the key is in their voting—they can exercise active input through the votes, and companies have to look at funds’ (eg Vanguard which is the 7th largest holder of the CAC40) record. This is how they can make a difference. In the US, the 2 main topics that passive investors actively vote on are: gender parity and climate activities/impact

Jean-Paul Agon, CEO L’Oréal shared a lot about balancing long-term and short-term shareholders (as the Bettencourt-Meyers family is the largest holder of L’Oréal). He has worked for 10 years as CEO (rare) and he has multiplied the company market cap by 3, +15% IRR over 10 years, 34 x P/E—so more than delivered for shareholders. His secret: “you have to know how to seize the opportunity that comes your way”—he doesn’t ever look at L’Oréal as ‘world leader’—he keeps a ‘contender mentality’, and keeps building: digitisation of beauty, universalisation (a word he invented because it’s not globalisation, as each market has its specificity, even though the brand is global—and he highlights Africa as a huge next potential market) and green beauty.

The Heidrick & Struggles and L’Express study on gender diversity at the head of companies threw up interesting data. For Boards, the European/French directive of having 40% women on Boards is achieved. In COMEX/CODIR the number is much lower: 20% for CAC40 companies and 19% for SBF-120. Quotas are being brought in for 20% by 2022 (largely achieved) and 40% by 2024- currently only 6 companies out of CAC40 and SBF-120 are there! CEO of Suez Bertrand Camus, who is one of the 6 to have already reached the 40% target, spoke a lot about his initiatives and his belief in pushing through the diversity actively. He has the conviction, and the proof in his company, that parity creates growth and success.

A statistical study done by Michel Ferrary of SKEMA Business School on the correlation between diversity and outperformance in the markets supports this: when companies have parity, it is at its best (too many women or men then decrease the performance curve)—better performance, beta below 1 (low volatility), good through downturns. Equilibrium is optimal.

Who are Shareholders of CAC40 and SBF-120 companies? Nicolas Evrard from Euronext shared findings that you can now find on the Euronext site. Families have made a comeback- no surprise as Hermès entered the CAC40 last year.

When asked whether Europe can deliver the Capital Markets Union that could push growth and opportunity, an eminent panel suggested one thing each: (Moderated by Anthony Attia, CEO Euronext France; Sylvie Goulard (Banque de France), Enrico Letta (former PM of Italy now Dean of SciencesPo), Steven Maijoor (Chairman of ESMA), Xavier Musca (CEO Credit Agricole), Frederic Oudéa (CEO Soc Gen))

Oudéa: financing of companies needs better balance between banks lending and the capital markets; equity needs to play a bigger role. Musca: it is essential now, especially in relation to Brexit, that the Europeans move fast to create their Capital Markets Union (CMU)—this needs strong European investment banks, strong infrastructure, broader investor base and a strong political will. Now there is no better option than to unify and create CMU (as UK veto will no longer exist post Brexit)—right now it’s still too fragmented, notably as the European countries have very different fiscal policies.

Securitisation is not a substitute for SME financing—it’s ok for consumer credits or mortgages, but not appropriate to help companies grow.

There is a need for harmonising the data—the European Commission is aware of investors’ frustrations that SMEs in different countries all report differently

Their Key Recommendations for a quick CMU were:

1. Create a ‘aha moment’ (déclic) by leveraging the green mood, fiscal incentives to make stock markets more attractive (Oudéa)

2. It’s a long journey but need to act fast on consistency of reporting across countries and Basel Regulation has to put banks in a position to compete with the US—so needs to be less stringent on share capital tests. (Letta)

3. Need common standard to measure and disclose sustainable/ESG data; cheaper distribution of products (Maijoor)

4. Integrate the CMU into the Brexit negotiations. Need to be clear that Europe can now compete; revise MiFID and Basel Agreement rules (Musca)

5. Good data and get a simple and effective taxation system- simplify and harmonise fast (Goulard)

Saint Gobain CEO, Pierre-André de Chalendar, looks to deliver long term value for shareholders and for society more broadly. He actually enjoys Larry Fink’s annual letter because he sets the bar high for companies. Amundi will be applying strict criteria in 2021/2022. So the big funds do pressure the companies, but as a CEO he likes this. His main concern today is that there is a need for green energy fast for their production. He sees himself as being able to preserve the company in order to pass it to his successors for another 350 years.

To finish it off, in an electrifying speech, Finance Minister Bruno Lemaire encouraged the Europeans to generate more growth in order to compete. “We have to set ambitions high: build our investment capability, our R&D, our development of AI, infrastructure spending….” He believes in a durable, green, de-carbonated economy that grows. He stated that there is lots of political ambition in France to find a ‘third-way’ capitalistic model that is not like China (state-led) or USA (complete liberalism) for Europe. Usula von der Leyen and Germans are aligned. He impressed the need to make that vision happen, and believes Euronext plays a big role as a pan-European platform.